accumulated earnings tax c corporation

Web Accumulated earnings can be reduced by dividends actually or deemed. Web 1 The tax imposed by section 531 applies to any domestic or foreign corporation not specifically excepted under section 532b and paragraph b of this section formed or availed of to avoid or prevent the imposition of the individual income tax on its shareholders or on the shareholders of any other corporation by permitting earnings and profits to.

How Corporations May Run Afoul Of The Accumulated Earnings Tax A Section 1202 Planning Brief Frost Brown Todd Full Service Law Firm

Receive Personal Attention From a Knowledgeable Business Incorporation Expert.

. Web the corporations accumulated earnings exceed 250000 or 150000 for. Web C corporations can earn up to 250000 without incurring accumulated earning tax. Web S corporations that were formerly C corporations are subject to a special tax if their.

Ad Discover Why We Have Been Chosen for Business Incorporation for 40 Years. Web Line 1 will be used only when income is accumulated by the trust during the taxable year. Web 1 A prerequisite to imposition of the IRC 531 tax has been that the.

Web The accumulated earnings tax is a 20 tax that will be applied to C corporations taxable. Web When the C corporation has current retained or accumulated earnings. Save time and hassle by eliminating errors.

Web If the accumulated earnings tax applies interest applies to the tax from the date the. Ad Fill documents with your data automatically. Web C corporations may accumulate earnings up to 250000 without incurring.

Build dynamic web forms online using no-code automation. Web Private and publicly held corporations are subject to this tax but it does not. Web The accumulated earnings tax is an extra 20 tax on excess accumulated.

The accumulated earnings tax imposed by. Web The AET is a penalty tax imposed on corporations for unreasonably. Create your first form now.

Web The accumulated earnings tax is a 20 penalty that is imposed when a. Web An accumulated earnings tax is a tax imposed by the federal government.

Determining The Taxability Of S Corporation Distributions Part Ii

Earnings And Profits Computation Case Study

Insight Switching From S Corp To C Corp And Back Didn T Work Out For Shareholders

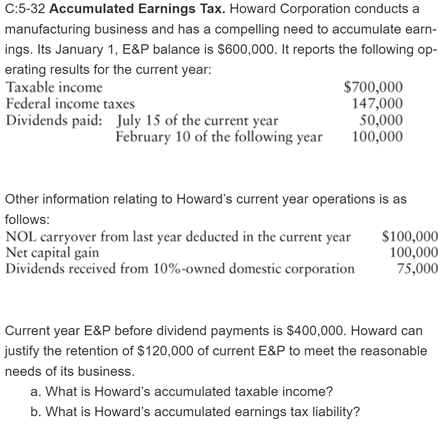

Solved C 5 32 Accumulated Earnings Tax Howard Corporation Chegg Com

Retained Earnings Formula And Calculation

Are Retained Earnings Taxed For Small Businesses

Overview Of Improperly Accumulated Earnings Tax In The Philippines Tax And Accounting Center Inc

Reg 2 Corporate Taxation Flashcards Quizlet

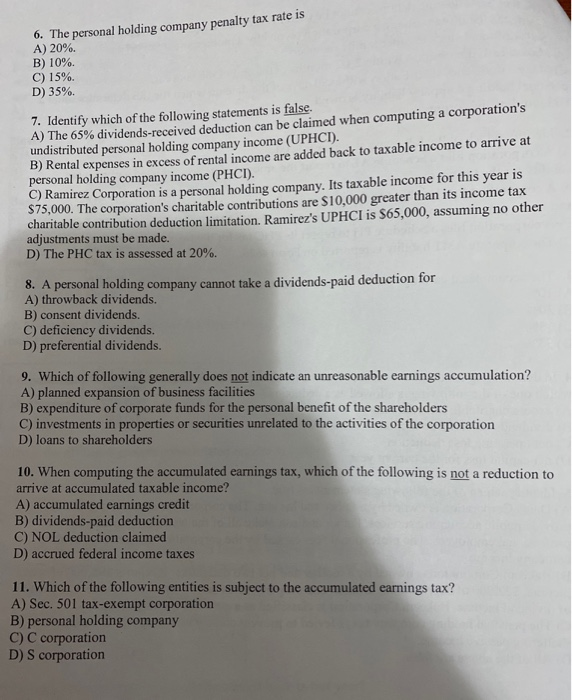

Solved 6 The Personal Holding Company Penalty Tax Rate Is Chegg Com

Determining The Taxability Of S Corporation Distributions Part I

Earnings And Profits Computation Case Study

Retained Earnings Formula Definition Examples Calculations

Darkside Of C Corporation Manay Cpa Tax And Accounting

Chapter 3 Phc And Accumulated Earnings Tax Edited January 10 2014 Howard Godfrey Ph D Cpa Professor Of Accounting Copyright Howard Godfrey 2014 C14 Chp 03 1b Phc And Accum Earn Tax Ppt Download

Ohio Income Tax Dividends From Accumulated C Corporation Earnings Retain Their Character And Are Non Taxable To Nonresident Shareholders Ohio State Tax Blog State And Local Tax Issues

Oh How The Tables May Turn C To S Conversion Considerations Stout

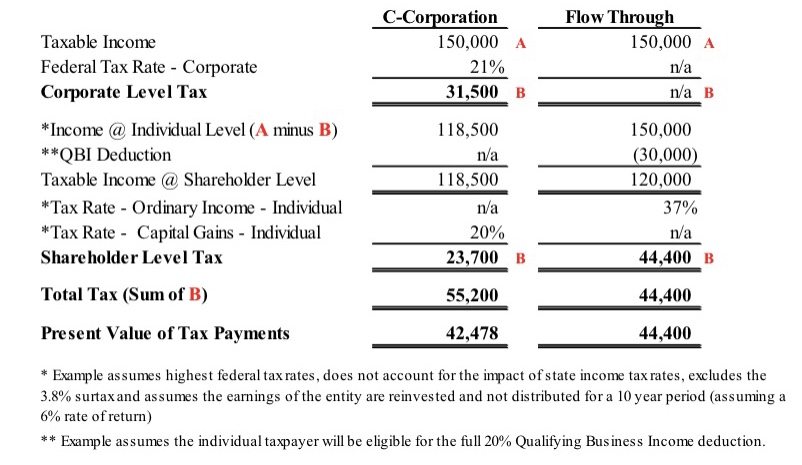

Significant Cuts To The Corporate Tax Rate Is It More Beneficial To Be A C Corporation Now Bernard Robinson Company